The Federal Reserve raised its key interest rate by half a percentage point on Wednesday – the biggest rate increase in 22 years – as the central bank battles against runaway inflation in the U.S.

The Fed bumped up the Fed Funds rate by half a percentage point to 0.75% and 1% and also announced a reduction in its balance sheet by $95 billion.

The Fed bumped up the Fed Funds rate by half a percentage point to 0.75% and 1% and also announced a reduction in its balance sheet by $95 billion.

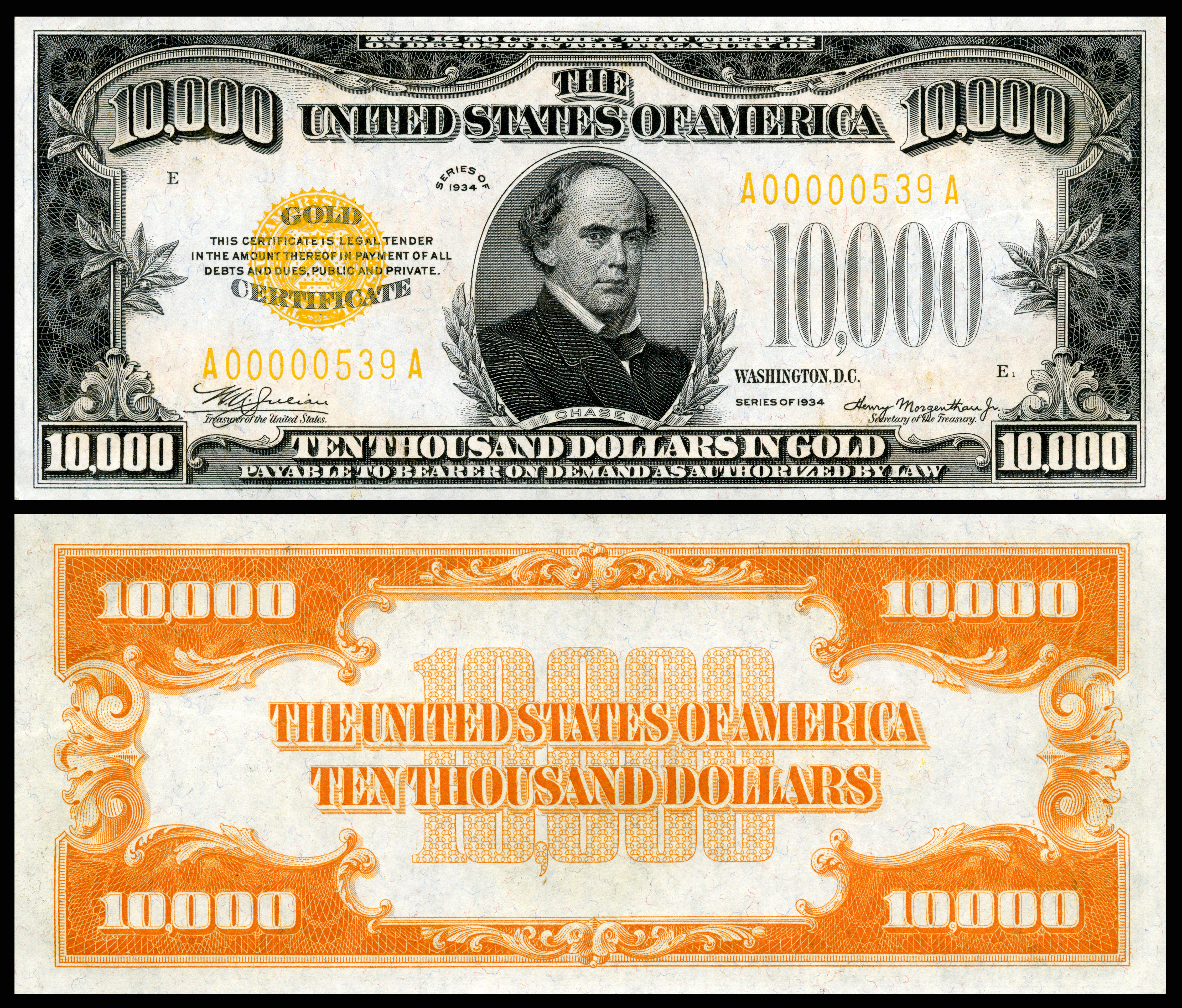

Gold climbed following the Fed’s announcement this afternoon, trading at $1,899 per ounce at the time of this writing.

What’s next? The large half-point interest rate hike will quickly ripple through the economy. Americans will face higher interest rates on everything from credit card bills, mortgage rates, auto loans and more.

Why Is the Fed Aggressively Raising Rates Now?

Inflation is robbing senior citizens who live on fixed incomes, and those with savings in the bank, by an outrageous amount, as the Fed stood idly by for many months. The latest consumer prices index (CPI) inflation number hit a shocking 8.5% in March. That number far exceeds the Fed’s stated goal of inflation at 2%.

While the Federal Reserve has been slow to act as inflation hit a 40-year high, the central bank must now play “catch-up” in its fight against skyrocketing consumer prices.

In order to slow down the pace of runaway inflation, the Fed will now be forced to raise interest rates more quickly and in larger increments than previously expected.

Normally, the Fed raises interest rates in smaller quarter point moves (.25) versus today’s half-percentage point (.50).

In its statement on Wednesday, the Federal Open Market Committee pointed to the Russian war in Ukraine as a factor impacting inflation. “The invasion and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity,” the Fed said.

What You Need to Know

It will be hard to put the inflation genie back in the bottle. The Federal Reserve is embarking on a journey that the U.S. central bank has never successfully accomplished in the past – trying to move inflation significantly lower without triggering a big uptick in unemployment.

The Fed could cause the economy to crash. While the Fed is aiming for a “soft landing” a “hard landing” for the economy is more likely. In fact, over the past 80 years, the Fed has never lowered inflation as much as it aims to do now (4 percentage points) without creating a recession, the Wall Street Journal reported on Wednesday.

How Gold Protects You Now and in the Future

The S&P 500 is already down 13% this year – officially entering correction territory. With a series of interest rate hikes guaranteed this year, the stock market will remain vulnerable to more declines – and even a crash.

Gold remains a rock-solid tangible asset that investors are turning to in order to protect and grow their wealth in these uncertain times. Research confirms that gold is a non-correlated asset to stocks and, historically, when stocks decline sharply, gold has posted significant gains.

With the threat of recession and further stock market declines on the horizon in 2022, the gold market offers proven portfolio diversification and store of value protection for investors. Wall Street firms like Wells Fargo and Bank of America forecast gold gains toward $2,100 and even $2,175 an ounce this year. That means current levels in gold offers investors an attractive buying opportunity. Have you considered if it’s time to increase your allocation to gold?

Want to read more? Subscribe to the Blanchard Newsletter and get our tales from the vault, our favorite stories from around the world and the latest tangible assets news delivered to your inbox weekly.

The post Is a Recession Just Around the Corner? appeared first on Blanchard and Company.